ADU Loan Program Management Database, OCHFT

Project Title & Client:

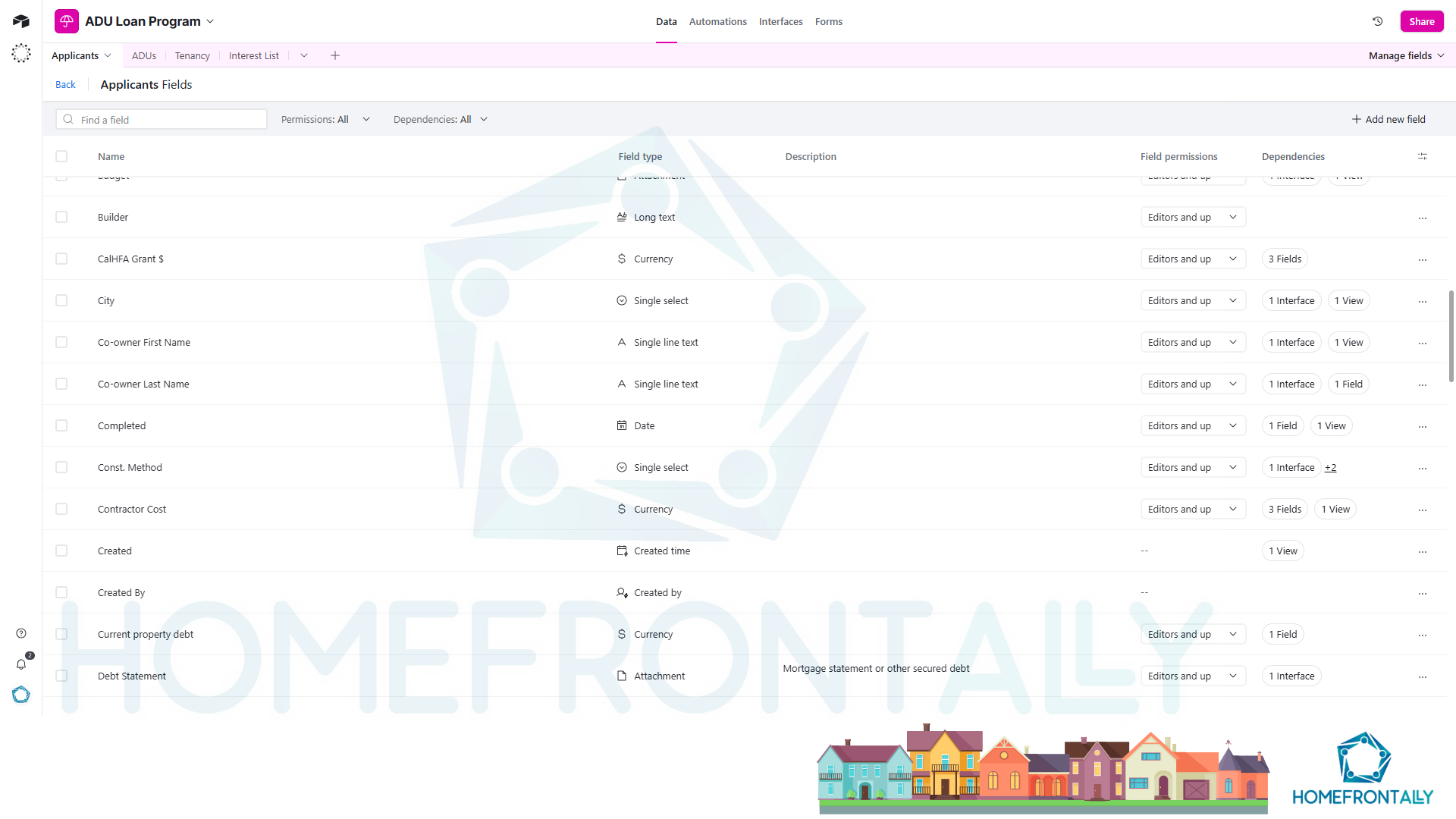

Accessory Dwelling Unit Loan Program CRM, application, and lending management tool; Orange County Housing Finance Trust

The Challenge:

The client, Orange County Housing Finance Trust, expanded its lending options in a radical new direction: direct residential loans to homeowners to fund the construction of new accessory dwelling units. Without any existing program or loan management tools, and with the prospect of tripling its loan volume compared to the more complex but also less regulated commercial multifamily lending it has historically done, the Trust had a pressing need to create a custom toolset to handle this increased volume.

Solution:

Using Airtable, Homefrontally created a customized base that included an interest list with pre-screening and data collection for impact & demand reporting, an online application with custom formulas to automate underwriting checks, a module for the loan with terms and process tracking, and post-construction tenancy monitoring to ensure compliance with income restrictions. This was designed to work as a single source of information for all tasks related to applicants, loans, and compliance for the Affordable ADU Loan Program, reducing task switching and information loss for the program manager.

Impact & Results:

After the completion of the ADU Loan Program Airtable base, the Trust decided to terminate the Affordable ADU Loan Program before any applications were collected. However, the tracker was successfully used to gather, interpret, and share information on the regional interest in building an ADU, including the size, type, and location. A few city members of the Trust who were pursuing their own ADU policies and programs were able to take advantage of the information as a market service for their cities.

Role:

Homefrontally led the full database design and implementation, including business analysis.